Kroger W-2 Form: Everything Employees Need to Know for Tax Season

If you work at Kroger, one of the most important tax documents you will receive each year is your W-2 form. This form is essential for filing your federal and state tax returns, and it outlines exactly how much you earned and how much tax was withheld from your paychecks in the previous calendar year.

Understanding your W-2, knowing when to expect it, and learning how to access it can save you a lot of time and stress when tax season arrives. This guide will walk you through everything you need to know, step-by-step.

What Is a Kroger W-2 Form?

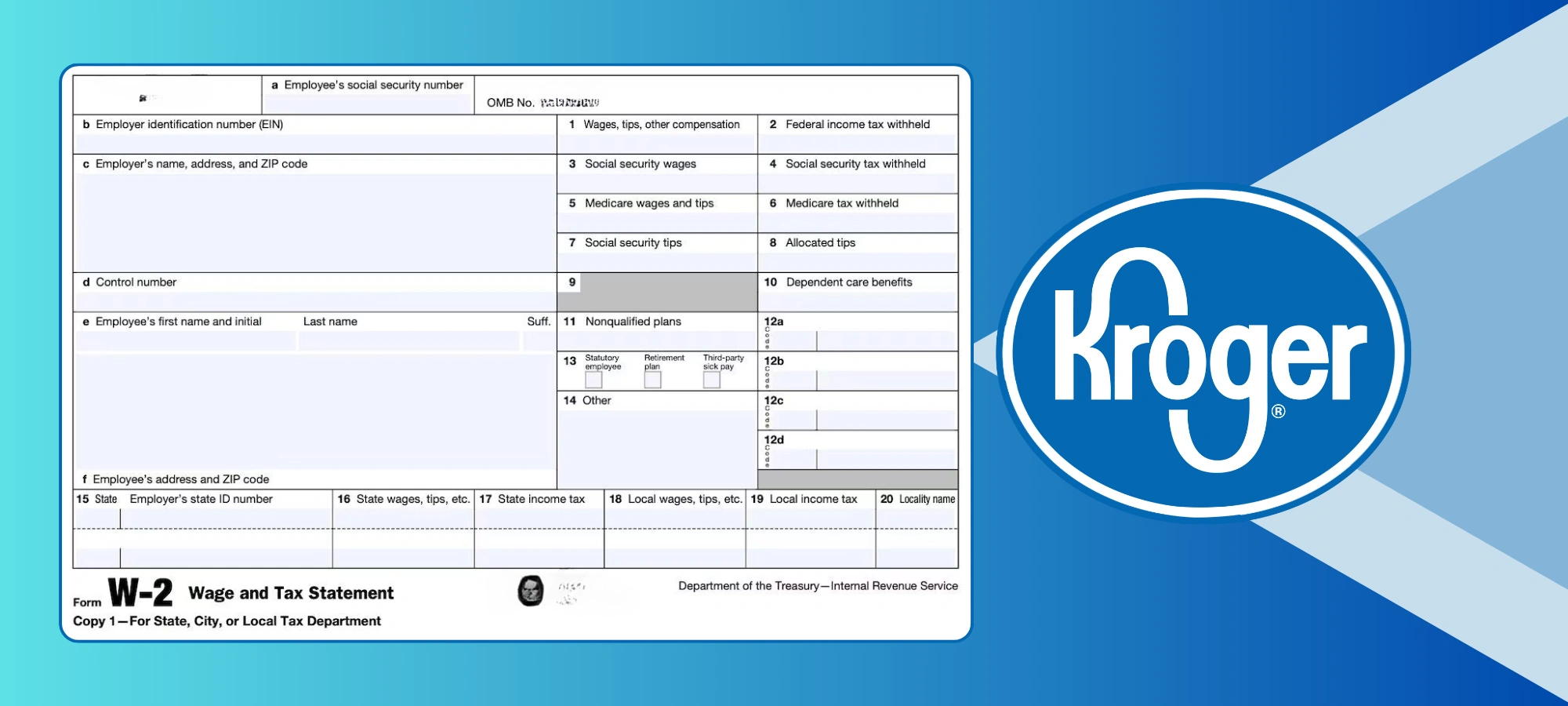

The W-2 form, also known as the Wage and Tax Statement, is a document employers are required to send to their employees by January 31st each year. It reports:

- Your total wages or salary for the year

- Federal, state, and local taxes withheld

- Social Security and Medicare contributions

- Any additional compensation or benefits

Kroger provides W-2s to all eligible employees — both current and former — who worked for the company in the previous tax year.

When Will You Receive Your Kroger W-2?

By law, Kroger must provide W-2 forms no later than January 31st. In most cases, employees can access their forms earlier through the Kroger Express HR portal. Paper copies are typically mailed to your address on file if you have not opted for electronic delivery.

Tip: Always make sure your mailing address and email are up-to-date in your Kroger employee account before December to avoid delays.

How to Access Your Kroger W-2 Online

Many Kroger employees prefer to access their W-2 electronically because it is faster and more convenient. Here is how you can do it:

- Visit the Kroger Express HR Portal at ess.kroger.com.

- Log in using your Enterprise User ID (EUID) and password.

- Navigate to the “My HR” section.

- Select “W-2 and Tax Information”.

- Choose the year you need and download your form.

If you have trouble logging in, you can call Kroger’s HR Express support line at 1-800-952-8889 for assistance.

Understanding Box 2 on Your W-2

One of the most important parts of your W-2 is Box 2, which shows the total amount of federal income tax withheld from your pay during the tax year.

This number is critical because:

- If the amount withheld is more than your actual tax liability, you may receive a refund.

- If the amount withheld is less than your tax liability, you will owe additional taxes when you file your return.

The figure in Box 2 is based on the information you provided on your W-4 form when you started or updated your employment details at Kroger.

Other Key Boxes on the Kroger W-2

While Box 2 gets a lot of attention, there are other sections of the form that are equally important:

- Box 1: Total taxable wages, tips, and other compensation.

- Box 3 & 5: Wages subject to Social Security and Medicare taxes.

- Box 4 & 6: Social Security and Medicare tax withheld.

- Box 12: Various codes for additional benefits or deductions.

- Box 16 & 17: State wages and state tax withheld.

Knowing what each box means can help you understand your earnings and deductions in more detail.

What If You Did Not Receive Your Kroger W-2?

If it’s mid-February and you still have not received your W-2, here’s what you should do:

- Check online through the Kroger Express HR portal.

- Verify your address on file to ensure it’s correct.

- Contact the Kroger HR Express team at 1-800-952-8889 to request a reissue.

- Check online through the Kroger Express HR portal.

- If you’re a former employee, you can still access your W-2 online or request a mailed copy.

How Your W-2 Affects Your Tax Return

The information from your W-2 feeds directly into your Form 1040 when you file your tax return. The IRS uses it to verify:

- How much you earned

- How much tax you already paid

- Whether you are due a refund or owe more taxes

Your tax outcome depends on factors like your total income, tax credits, deductions, and the withholding amount listed on your W-2.

Tips for a Smooth Tax Season with Your Kroger W-2

- Access it early so you have time to fix any mistakes before filing.

- Double-check details like your Social Security number and personal information.

- Keep a copy (digital or paper) for at least three years in case of an audit.

- Access it early so you have time to fix any mistakes before filing.

- If you move, update your address in the HR system immediately.

Final Thoughts

Your Kroger W-2 is more than just a piece of paper — it’s the key to accurately filing your taxes and ensuring you get the refund you deserve or avoid unexpected bills. By understanding what it contains and knowing how to access it, you can make tax season far less stressful.

If you ever run into issues, remember Kroger’s HR Express team is there to help at 1-800-952-8889.